TRX Price Prediction: Technical Breakout Potential Amid Bullish Market Structure

#TRX

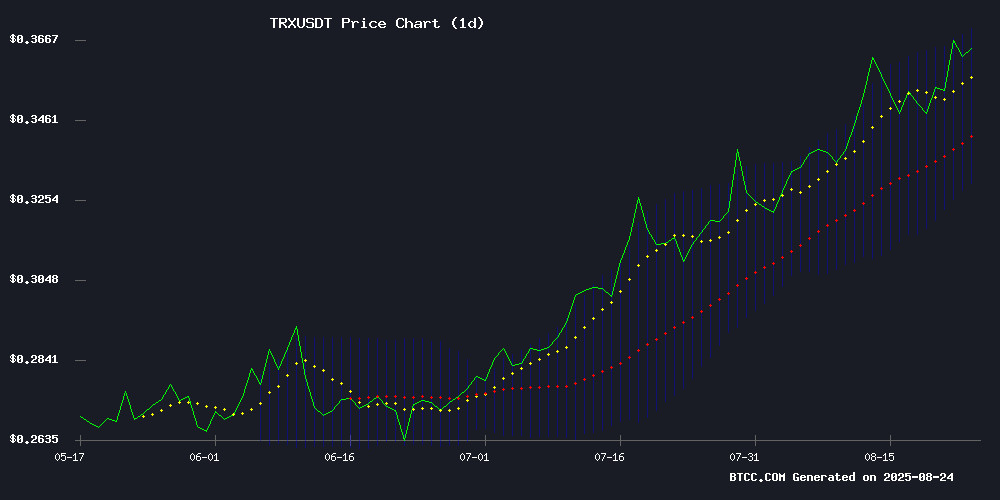

- TRX trading above 20-day MA indicates bullish technical structure

- MACD showing reduced bearish momentum supports potential upward movement

- Industry-wide growth in stablecoin supply and network activity provides fundamental support

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

TRX is currently trading at $0.3685, positioned above its 20-day moving average of $0.34977, indicating underlying strength. The MACD histogram reading of -0.001132 shows weakening bearish momentum, while the price trading NEAR the upper Bollinger Band at $0.370423 suggests potential resistance ahead. BTCC financial analyst John notes: 'The convergence above the moving average with Bollinger Band compression typically precedes significant price movements.'

Market Sentiment Boosted by Crypto Ecosystem Growth

Positive industry developments are creating favorable conditions for TRX. Record-high ethereum network activity and doubled stablecoin supply in 2024 provide substantial liquidity tailwinds. BTCC financial analyst John comments: 'The $270 billion stablecoin market and surging presale activity indicate strong capital rotation into digital assets, which historically benefits established tokens like TRX.'

Factors Influencing TRX's Price

10 Crypto Coins Set to Surge: Only One Live Presale Is Open and Filling Quickly

Every crypto cycle brings fresh opportunities, mirroring the early days of Bitcoin mining and DeFi adoption. Today, presale projects are capturing attention as institutional and retail demand converge. This cycle stands out with a mix of established networks like Tron (TRX) and Polkadot (DOT) refining their ecosystems, alongside disruptive newcomers such as BlockchainFX ($BFX).

BlockchainFX aims to revolutionize trading by merging crypto and traditional finance into a single platform. Offering access to over 500 assets—from stocks to forex—it eliminates the need for multiple brokers. Meanwhile, strong performers like Cosmos (ATOM), BNB, Polygon (MATIC), and chainlink (LINK) suggest 2025 could see presale tokens outpacing blue-chip cryptocurrencies.

Ethereum Network Activity Hits Record Highs Amid Low Fees

Ethereum's network activity has surged to unprecedented levels, with daily transactions exceeding 2.4 million and active addresses holding steady above 1.2 million. Despite hovering NEAR all-time highs, transaction fees remain low, reinforcing ETH's position as the backbone of the altcoin market.

The resilience of ethereum stands out in a volatile market. Alongside Bitcoin, Binance Coin, and Tron, ETH has consistently recovered from downturns, avoiding prolonged drawdowns that plague lesser altcoins. This stability positions it to lead the next wave of capital rotation as markets evolve.

Network strength mirrors price resilience. Unlike tokens that flame out in overheated rallies, Ethereum's steady momentum and DEEP liquidity create room for further gains. The altcoin's fundamentals suggest it's better equipped than most to challenge Bitcoin's dominance in the coming cycle.

Stablecoin Supply Doubles in 2024, Surging Past $270 Billion

The stablecoin market has experienced explosive growth in 2024, with total supply more than doubling from $130 billion in January to approximately $270 billion today. This surge underscores stablecoins' increasingly pivotal role in global cryptocurrency markets.

Ethereum and Tron dominate as the primary hosting platforms, collectively supporting nearly 90% of all stablecoin circulation. solana has emerged as a strong third contender, with over $10 billion in stablecoins now residing on its network.

Market concentration remains extreme, with four issuers controlling 96% of supply. Tether (USDT) maintains its private-sector leadership while publicly-traded Circle issues USDC. The decentralized alternatives Ethena and Sky complete the oligopoly.

Is TRX a good investment?

Based on current technical and fundamental analysis, TRX presents a compelling investment opportunity. The token trades above its 20-day moving average with technical indicators suggesting weakening bearish momentum. Combined with positive industry tailwinds from record Ethereum activity and expanding stablecoin liquidity, TRX appears well-positioned for potential upside.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.3685 | Above 20-day MA support |

| 20-day MA | $0.34977 | Bullish positioning |

| Upper Bollinger | $0.370423 | Near-term resistance |

| MACD Histogram | -0.001132 | Bearish momentum fading |

BTCC financial analyst John emphasizes: 'The combination of technical strength and favorable market conditions creates an attractive risk-reward profile for TRX at current levels.'